News

American Creek Resources Announces Amendment to Plan of Arrangement with Cunningham Mining

Cardston, Alberta--(Newsfile Corp. - December 31, 2024) - American Creek Resources Ltd. (TSXV: AMK) (OTCQB: ACKRF) (the "Company" or "American Creek") announces that it has entered into an amendment agreement (the "Amendment Agreement") with Cunningham Mining Ltd. (the "Purchaser") to amend the previously announced arrangement agreement between the Purchaser and the Company dated September 5, 2024 (the "Arrangement Agreement") pursuant to which, among other things, the Purchaser will acquire all of the issued and outstanding common shares of American Creek by way of a statutory plan of arrangement (the "Arrangement") under Division 5 of Part 9 of the Business Corporations Act (British Columbia).

Under the Amendment Agreement, the Outside Date (as defined in the Arrangement Agreement) has been extended from December 30, 2024 to January 31, 2025. In addition, the parties have agreed to remove the termination payment obligation previously required in the event the Company accepted a superior proposal. A copy of the Amendment Agreement will be available on the Company's profile on SEDAR+ at www.sedarplus.ca.

For further information on the Arrangement, please see the Company's news releases dated September 6, 2024, October 2, 2024, October 31, 2024 and December 2, 2024, which are available on American Creek's profile on SEDAR+ at www.sedarplus.ca.

About American Creek and the Treaty Creek Project

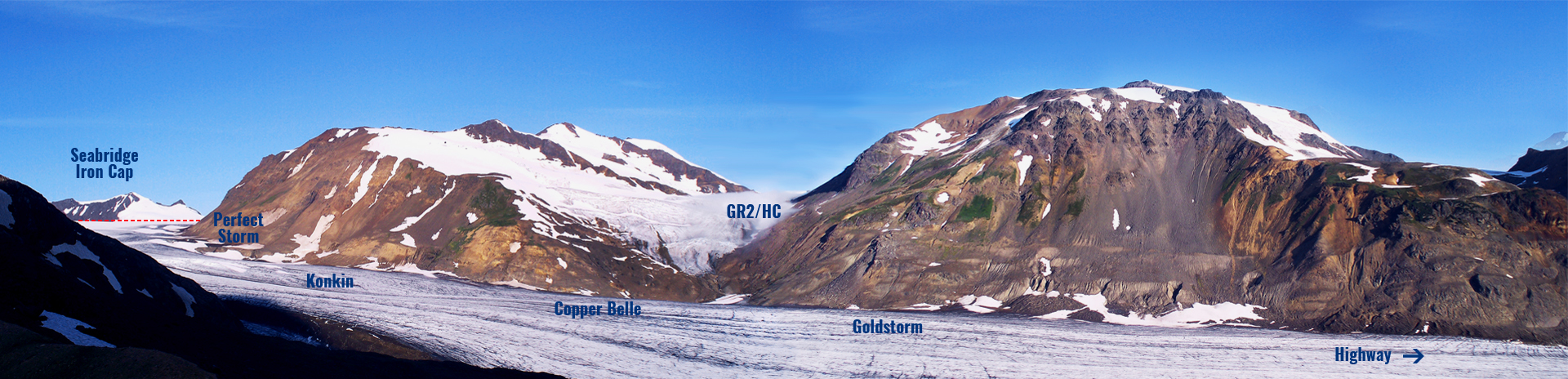

American Creek is a proud partner in the Treaty Creek Project, a joint venture with Tudor Gold Corp. located in BC's prolific "Golden Triangle".

American Creek holds a fully carried 20% interest in the Treaty Creek Project until a production notice is given, meaning that no exploration or development costs are incurred by American Creek until such time as a production notice has been issued. American Creek shareholders have a unique opportunity to avoid the dilutive effects of exploration while maintaining their full 20% exposure to one of the world's most exciting mega deposits.

The Company also holds the Austruck-Bonanza gold property located near Kamloops, BC.

ON BEHALF OF AMERICAN CREEK RESOURCES LTD.

"Darren Blaney"

Darren Blaney, President & CEO

For further information please contact Kelvin Burton at:

Phone: (403) 752-4040 or Email: This email address is being protected from spambots. You need JavaScript enabled to view it..

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Statements

This news release may contain forward-looking statements (within the meaning of applicable securities laws) which reflect American Creek's current expectations regarding future events. Forward-looking statements are identified by words such as "believe", "anticipate", "project", "expect", "intend", "plan", "will", "may", "estimate" and other similar expressions. The forward-looking statements in this news release are based on a number of key expectations and assumptions made by American Creek as of the date hereof. Although the forward-looking statements contained in this news release are based on what American Creek's management believes to be reasonable assumptions, American Creek cannot assure investors that actual results will be consistent with such statements.

The forward-looking statements in this news release are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Several factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including those identified in American Creek's most recent Management's Discussion and Analysis, which is available on SEDAR+ at www.sedarplus.ca. Readers, therefore, should not place undue reliance on any such forward-looking statements. These forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, American Creek assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/235631

American Creek Resources Announces Shareholder Approval of Plan of Arrangement with Cunningham Mining and Receipt of Final Order

Cardston, Alberta--(Newsfile Corp. - December 2, 2024) - American Creek Resources Ltd. (TSXV: AMK) (OTCQB: ACKRF) (the "Company" or "American Creek") is pleased to announce that further to its press releases of September 6, 2024, October 2, 2024 and October 31, 2024, that the special resolution ("Special Resolution") to authorize and approve the previously announced statutory plan of arrangement (the "Arrangement") involving American Creek and Cunningham Mining Ltd. (the "Purchaser") under Division 5 of Part 9 of the Business Corporations Act (British Columbia) ("BCBCA"), whereby, among other things, the Purchaser will acquire all of the issued and outstanding common shares of American Creek, was overwhelmingly approved at the annual general and special meeting of shareholders of the Company (the "Meeting") held November 27, 2024.

At the Meeting, the Special Resolution authorizing and approving the Arrangement was approved by (i) 99.3% of the shareholders of the Company present in person or represented by proxy at the Meeting, and (ii) 99.28% of the minority shareholders of the Company (being those common shares of the Company beneficially owned or controlled by shareholders other than Darren Blaney, his related parties and joint actors, whose votes were required to be excluded from the minority vote in accordance with Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions) present in person or represented by proxy at the Meeting. 292,984,192 shares, being approximate 65.24% of the issued and outstanding shares of American Creek, were represented at the Meeting.

At the Meeting, all other resolutions presented to the shareholders were also approved, including re-appointing Dale Matheson Carr-Hilton Labonte LLP as auditor of the Company, setting the number of directors at four, re-electing Darren Blaney, Rob Edwards, Dennis Edwards and Tobin Wood as directors of the Company, and approving the continued use of the Company's stock option plan.

In addition, on November 29, 2024, the Company obtained the final order from the Supreme Court of British Columbia approving the Arrangement under Division 5 of Part 9 of the BCBCA.

Completion of the Arrangement remains subject to, among other things, satisfaction of all conditions precedent to closing the Arrangement. A closing date for this transaction will be determined once all conditions to the closing of the Arrangement are satisfied or waived.

About American Creek and the Treaty Creek Project

American Creek is a proud partner in the Treaty Creek Project, a joint venture with Tudor Gold Corp. located in BC's prolific "Golden Triangle".

American Creek holds a fully carried 20% interest in the Treaty Creek Project until a production notice is given, meaning that no exploration or development costs are incurred by American Creek until such time as a production notice has been issued. American Creek shareholders have a unique opportunity to avoid the dilutive effects of exploration while maintaining their full 20% exposure to one of the world's most exciting mega deposits.

The Company also holds the Austruck-Bonanza gold property located near Kamloops, BC.

ON BEHALF OF AMERICAN CREEK RESOURCES LTD.

"Darren Blaney"

Darren Blaney, President & CEO

For further information please contact Kelvin Burton at:

Phone: (403) 752-4040 or Email: This email address is being protected from spambots. You need JavaScript enabled to view it..

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Statements

This news release may contain forward-looking statements (within the meaning of applicable securities laws) which reflect American Creek's current expectations regarding future events. Forward-looking statements are identified by words such as "believe", "anticipate", "project", "expect", "intend", "plan", "will", "may", "estimate" and other similar expressions. The forward-looking statements in this news release include statements with respect to the completion of the Arrangement and the timing therefore. The forward-looking statements in this news release are based on a number of key expectations and assumptions made by American Creek as of the date hereof, including that all conditions to the completion of the Arrangement will be satisfied or waived. Although the forward-looking statements contained in this news release are based on what American Creek's management believes to be reasonable assumptions, American Creek cannot assure investors that actual results will be consistent with such statements.

The forward-looking statements in this news release are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Several factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including those identified in American Creek's most recent Management's Discussion and Analysis, which is available on SEDAR+ at www.sedarplus.ca and, in respect of the Arrangement, those factors set out under the heading "Risk Factors" in the Company's management information circular dated October 23, 2024, which is available on SEDAR+ at www.sedarplus.ca. Readers, therefore, should not place undue reliance on any such forward-looking statements. These forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, American Creek assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/232112

American Creek Resources Announces Mailing of Meeting Materials and Receipt of Interim Order in Respect of Plan of Arrangement with Cunningham Mining

Cardston, Alberta--(Newsfile Corp. - October 31, 2024) - American Creek Resources Ltd. (TSXV: AMK) (OTCQB: ACKRF) (the "Company" or "American Creek") announces that its management information circular (the "Circular") and related meeting materials were mailed today, October 31, 2024, for its annual general and special meeting (the "Meeting") of the Company's shareholders (the "Shareholders") to approve, amongst other things, a statutory plan of arrangement (the "Arrangement") involving American Creek and Cunningham Mining Ltd. (the "Purchaser") under Division 5 of Part 9 of the Business Corporations Act (British Columbia) ("BCBCA"). The Arrangement is subject to the terms and conditions of an arrangement agreement (the "Arrangement Agreement") summarized in the Company's September 6, 2024 news release and more particularly described in the Circular. Under the terms of the Arrangement Agreement, among other things, the Purchaser will acquire all of the issued and outstanding common shares of American Creek at a price of $0.43 per share.

The Circular and related Meeting materials have been publicly filed by American Creek under its issuer profile on SEDAR+ at www.sedarplus.ca.

Prior to entering into the Arrangement Agreement, the board of directors of the Company unanimously determined that the Arrangement is fair to all securityholders of the Company (Shareholders, warrantholders and optionholders) and that the Arrangement and the entering into of the Arrangement Agreement were in the best interests of the Company. The board of directors of the Company recommends that Shareholders vote FOR the Arrangement.

The Meeting

The Meeting will be held on Wednesday, November 27, 2024 at 10:00 a.m. (Vancouver Time) at 5th Floor, 410 West Georgia Street, Vancouver, British Columbia. At the Meeting, in addition to the typical general meeting items of business, Shareholders will be asked to consider, and, if deemed advisable, pass, with or without amendment, a special resolution of the Shareholders to approve the Arrangement (the "Arrangement Resolution").

The Circular, form of proxy, voting instruction form and letter of transmittal, as applicable, for the Meeting contain comprehensive information with respect to how registered and beneficial Shareholders may vote on the matters to be considered at the Meeting. As noted above, the Circular and other Meeting materials are also available under the Company's profile on SEDAR+ at www.sedarplus.ca. Only Shareholders of record as of the close of business on Wednesday, October 23, 2024, and their duly appointed proxyholders, are eligible to vote at the Meeting.

The deadline for completed proxies to be received by the Company's transfer agent is Monday, November 25, 2024 at 10:00 a.m. (Vancouver Time).

Receipt of Interim Court Order

The Company also announces that on Monday, October 21, 2024, it obtained the interim order (the "Interim Order") providing for the calling and holding of the Meeting and other procedural matter from Supreme Court of British Columbia regarding the Arrangement.

Completion of the Arrangement remains subject to, among other things, (i) approval of the Arrangement Resolution at the Meeting, (ii) receipt of the final approval of the Supreme Court of British Columbia, and (iii) other customary closing conditions set forth in the Arrangement Agreement.

About American Creek and the Treaty Creek Project

American Creek is a proud partner in the Treaty Creek Project, a joint venture with Tudor Gold Corp. located in BC's prolific "Golden Triangle".

American Creek holds a fully carried 20% interest in the Treaty Creek Project until a production notice is given, meaning that no exploration or development costs are incurred by American Creek until such time as a production notice has been issued. American Creek shareholders have a unique opportunity to avoid the dilutive effects of exploration while maintaining their full 20% exposure to one of the world's most exciting mega deposits.

The Company also holds the Austruck-Bonanza gold property located near Kamloops, BC.

ON BEHALF OF AMERICAN CREEK RESOURCES LTD.

"Darren Blaney"

Darren Blaney, President & CEO

For further information please contact Kelvin Burton at:

Phone: (403)752-4040 or Email: This email address is being protected from spambots. You need JavaScript enabled to view it..

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Statements

This news release may contain forward-looking statements (within the meaning of applicable securities laws) which reflect American Creek's current expectations regarding future events. Forward-looking statements are identified by words such as "believe", "anticipate", "project", "expect", "intend", "plan", "will", "may", "estimate" and other similar expressions. The forward-looking statements in this news release are based on a number of key expectations and assumptions made by American Creek as of the date hereof. Although the forward-looking statements contained in this news release are based on what American Creek's management believes to be reasonable assumptions, American Creek cannot assure investors that actual results will be consistent with such statements.

The forward-looking statements in this news release are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Several factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including those identified in American Creek's most recent Management's Discussion and Analysis, which is available on SEDAR+ at www.sedarplus.ca. Readers, therefore, should not place undue reliance on any such forward-looking statements. These forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, American Creek assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/228477

American Creek's JV Partner Tudor Gold Announces Positive Metallurgical Testing Results for the Goldstorm Deposit at Treaty Creek, Located in the Heart of the Golden Triangle, Northwestern British Columbia

Cardston, Alberta--(Newsfile Corp. - October 25, 2024) - American Creek Resources Ltd. (TSXV: AMK) ("the Corporation" or "American Creek") is pleased to announce that project operator and JV partner Tudor Gold ("Tudor") has given an update to ongoing metallurgical testwork on the Goldstorm gold, copper and silver deposit, located on the Treaty Creek Project situated within the Golden Triangle of British Columbia.

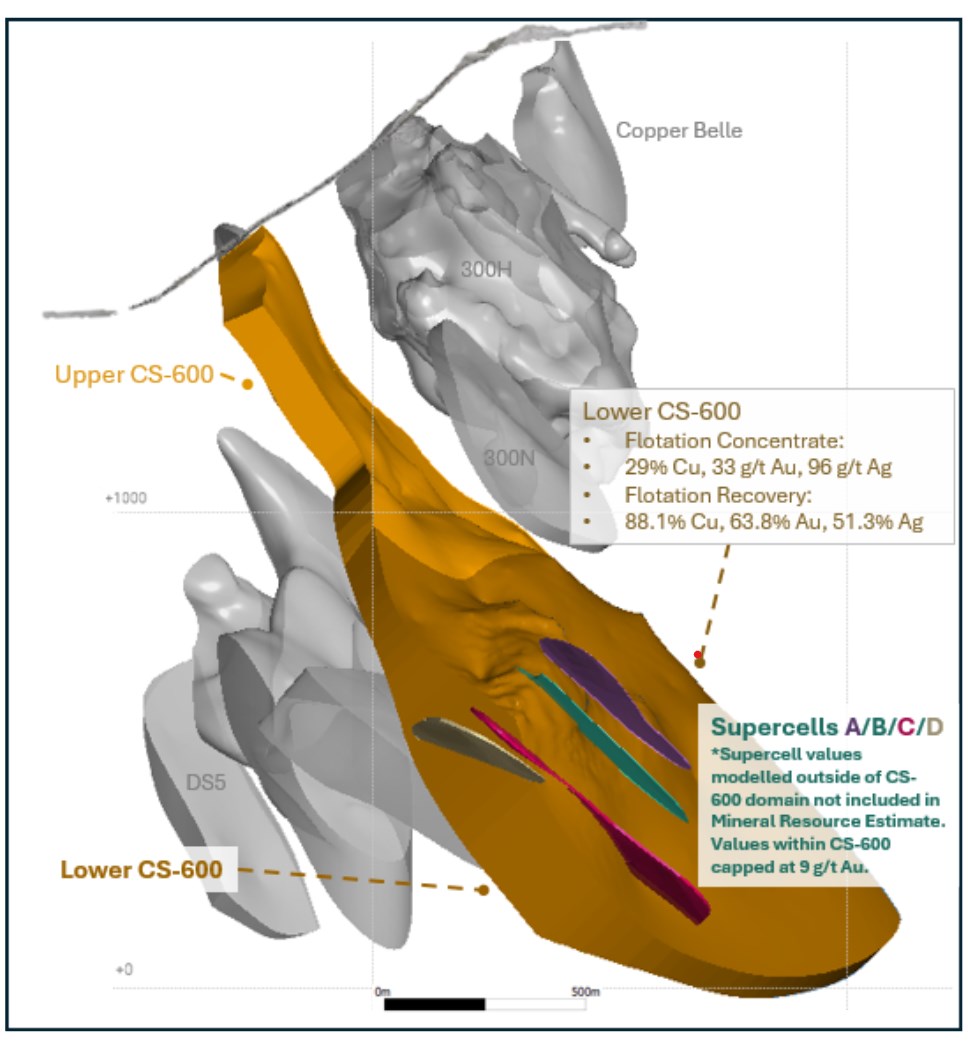

Highlights from the Metallurgical Testing on the Lower CS-600 Sub-Domain include:

- Flotation recoveries within the Lower CS-600 sub-domain totaled up to 88.1% copper, 63.8% gold, and 51.3% silver;

- Flotation testing confirmed that a high-grade copper concentrate with significant quantities of gold can be produced from the Lower CS-600 sub-domain, that exceed 29% copper with significant gold and silver grades of 33 g/t and 96 g/t, respectively;

The flotation program uses a typical copper flowsheet to produce the saleable copper concentrate mentioned above. Further flotation testwork is ongoing to produce a separate pyrite concentrate containing gold and silver. The positive results from flotation, in conjunction with previous oxidative leaching methods (such as Pressure Oxidation or Albion), continue to support the previously reported gold recoveries of 90% for the Lower CS-600 domain. The testing program was designed and executed with sufficient rigor to support a future Preliminary Economic Assessment (PEA).

Commenting on the results, Ken Konkin, President & CEO of Tudor Gold, stated, "We are very pleased with the results obtained from the locked-cycle flotation tests from this phase of metallurgical testing on material from the lower portion of the CS-600 Domain (CS-600L). We estimate more than 50% of the CS-600 Domain is located within the lower portion (the CS-600L sub-domain). Through a simple rougher-cleaner flotation process we were able to produce an exceptionally clean, high-grade concentrate with excellent metal recoveries, with over 88% for copper and approximately 64% for gold. The CS-600L sub-domain is located in the same area which hosts the newly discovered Supercell-1 (SC-1) high-grade gold complex. Our engineering team has recommended initial metallurgical tests to be conducted on material collected from the SC-1 drill hole intercepts. The SC-1 composite sample will be shipped to SGS Labs for metallurgical tests.

Our concept is to focus on the high-grade SC-1 to study the possibility of extracting as much high-grade gold as possible while potentially building out the infrastructure to access the CS-600L area. The plan is to utilize the same workings from the Supercell complex to access the CS-600 domain. These latest results from the CS-600L Domain significantly de-risk the Goldstorm project with respect to metallurgical characteristics of the copper-gold mineralization and will be utilized in a future Preliminary Economic Assessment (PEA).

Additionally, two gold-dominant domains, 300H and DS5, have demonstrated high gold recoveries from previous oxidation/cyanidation tests, with results exceeding 94% gold recovery for the Albion process and in excess of 98% gold recovery for pressure oxidation tests. We were very pleased to observe that no deleterious compounds were formed from any of the types of oxidation-leach tests completed, which will allow our technical team to conduct trade-off studies for recovery vs costs for each process. Given the favorable metallurgical test results obtained from this gravity/flotation system for the CS-600L sub-domain, testing and potentially expanding the SC-1 high-grade gold complex will be our primary focus moving forward. Additional tests are also recommended to examine the northernmost part of CS-600 (CS-600N) which has never been tested previously and continued tests on the upper CS-600 (CS-600U). However, the lower portion of CS-600 has enough volume to mine and process 40,000 tpd over 17 years producing a highly desirable copper concentrate with good gold and silver credits. The goal for the Treaty Creek Deposit is to be able to produce at least 500,000 AuEQ ounces per year. Our mineral process engineers can determine the optimal size and type of mineral processing to be considered for advancing the project that will part of the PEA with a series of trade-off studies examining the most economical path forward for the Treaty Creek Project."

GOLDSTORM DEPOSIT - Viewing Southwest (220°/-10°)

Figure 1

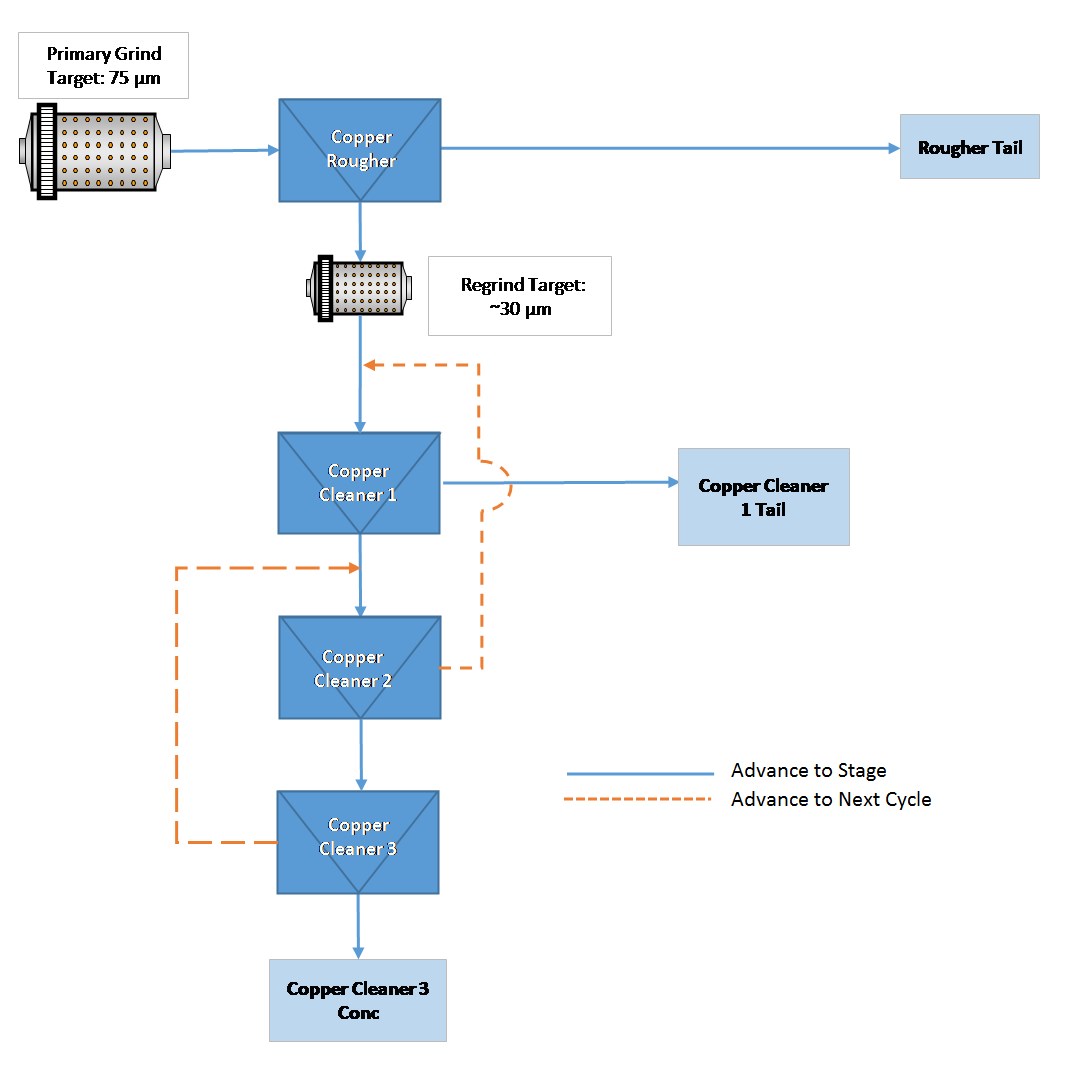

Metallurgical Test Work and Results:

Recent metallurgical testing carried out at Blue Coast Research, under the supervision of Tad Crowie, P. Eng. of JDS Energy & Mining Inc. demonstrated that a high-grade copper concentrate could be produced from the Lower CS-600 sub-domain. The locked cycle test achieved recoveries of 88.1% copper, 63.8% gold, and 51.3% silver into a concentrate with grade exceeding 29% copper and 30 g/t Au for the Lower CS-600. A locked cycle test is considered an important step in developing a mineral processing flowsheet which incorporates flotation, as it demonstrates the effects that re-cycle streams will have on the overall process. The tests were completed on samples that are consistent with those used for the previous metallurgical testing and had gold and copper feed grades of 0.91 g/t Au and 0.59% Cu, which are consistent with the grades in the Lower CS-600 sub-domain.

The current flotation flowsheet follows a typical copper flotation circuit configuration, with standard copper flotation reagents, as seen in Figure 2. The primary grind in the current testwork has been reduced from a P80 of 120 µm used in the previous testwork program to a P80 of 75 µm allowing for a higher overall recovery of copper than has been previously achieved. The gold recoveries have achieved similar results to previous flotation testwork.

Locked Cycle Test Flowsheet:

Figure 2 - Source: Blue Coast Research (2024)

A rougher concentrate regrind target of P80 of 30 µm allowed the production of a high-grade copper concentrate, exceeding 29% copper with significant gold and silver grades of 33 g/t Au and 96 g/t Ag for CS-600L.

The locked cycle test results for the combined products of last 3 cycles of the test (cycles 4, 5, and 6) can be found in the table below. The locked cycle test achieved stability after the first 2 cycles, which demonstrates that the flowsheet is stable, as well as validating the test results.

Highlights of the 2024 Locked Cycle testing on the Lower CS-600 Sub-Domain:

| Product | Weight | Assays | Distribution | |||||||

| grams | % | Au (g/t) | Ag (g/t) | Cu (%) | S (%) | Au % | Ag % | Cu % | S % | |

| Cleaner 3 Conc | 105.0 | 1.8 | 33.16 | 96.7 | 29.59 | 33.2 | 63.8 | 51.3 | 88.1 | 21.6 |

| Cleaner 1 Tail | 358.0 | 6.0 | 1.12 | 9.20 | 0.7 | 4.9 | 7.4 | 16.7 | 7.0 | 10.9 |

| Rougher Tail | 5532.7 | 92.3 | 0.28 | 1.14 | 0.03 | 1.97 | 28.8 | 32.0 | 4.9 | 67.5 |

| Calculated Head | 5995.7 | 100.0 | 0.91 | 3.30 | 0.59 | 2.69 | 100.0 | 100.0 | 100.0 | 100.0 |

Table 1 - Source: Blue Coast Research (2024)

The high copper concentrate grade, along with high levels of gold and silver, achieved in this test suggests that there are opportunities to pull the circuit harder to increase overall metal recovery.

QA/QP

The metallurgical program was carried out by Blue Coast Research of Nanaimo, B.C., selected to conduct further mineralogical assessment of the Goldstorm sample material. The metallurgical and mineralogical work was conducted under the supervision of Tad Crowie, P. Eng of JDS Energy & Mining Inc., a Qualified Person as defined by NI 43-101. Mr. Crowie has reviewed this news release and agreed to its contents.

Ken Konkin, P.Geo, President and CEO, Tudor Gold, is the Qualified Person, as defined by National Instrument 43-101, responsible for the Project. Mr. Konkin has reviewed, verified, and approved the scientific and technical information in this news release.

Standard QA/QC sampling procedures are maintained by SGS and Blue Coast to ensure accurate and representative testing.

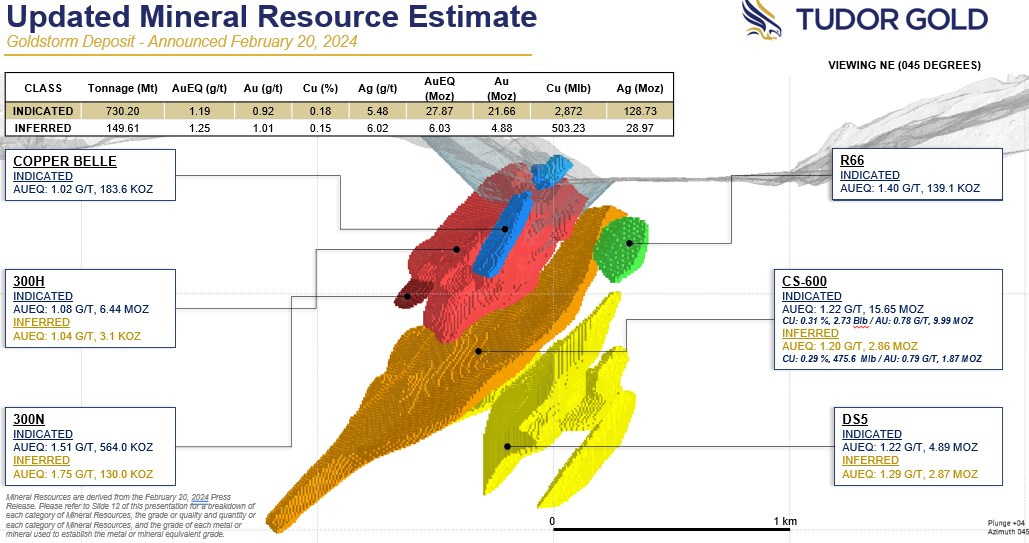

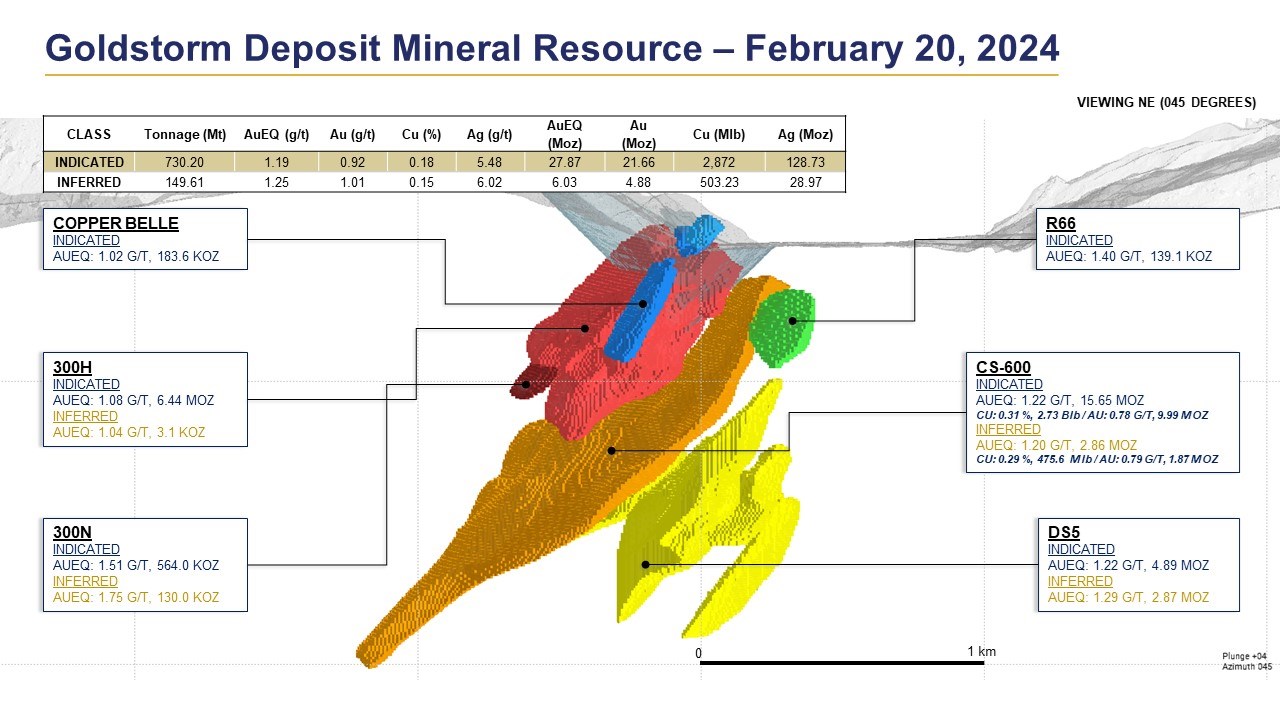

About Treaty Creek

The Treaty Creek Project hosts the Goldstorm Deposit, comprising a large gold-copper porphyry system, as well as several other mineralized zones. As disclosed in the "NI-43-101 Technical Report for the Treaty Creek Project", dated April 5, 2024 prepared by Garth Kirkham Geosystems and JDS Energy & Mining Inc., the Goldstorm Deposit has an Indicated Mineral Resource of 27.87 million ounces (Moz) of AuEQ grading 1.19 g/t AuEQ (21.66 Moz gold grading 0.92 g/t, 2.87 billion pounds (Blbs) copper grading 0.18%, 128.73 Moz silver grading 5.48 g/t) and an Inferred Mineral Resource of 6.03 Moz of AuEQ grading 1.25 g/t AuEQ (4.88 Moz gold grading 1.01 g/t, 503.2 Mlb copper grading 0.15%, 28.97 Moz silver grading 6.02 g/t), with a pit constrained cut-off of 0.7 g/t AuEQ and an underground cut-off of 0.75 g/t AuEQ.

The Goldstorm Deposit has been categorized into three dominant mineral domains and several smaller mineral domains. The CS-600 domain largely consists of nested pulses of diorite intrusive stocks and hosts the majority of the copper mineralization within the Goldstorm Deposit. CS-600 has an Indicated Mineral Resource of 15.65 Moz AuEQ grading 1.22 g/t AuEQ (9.99 Moz gold grading 0.78 g/t, 2.73 Blbs copper grading 0.31%, 73.47 Moz silver grading 5.71 g/t) and an Inferred Mineral Resource of 2.86 Moz AuEQ grading 1.20 g/t AuEQ (1.87 Moz gold grading 0.79 g/t, 475.6 Mlb copper grading 0.29%, 13.4 Moz silver grading 5.63 g/t). The Goldstorm Deposit remains open in all directions and requires further exploration drilling to determine the size and extent of the Deposit.

1 AuEq = Au g/t + (Ag g/t*0.0098765) + (Cu ppm*0.0001185)

Treaty Creek JV Partnership

American Creek is a proud partner in the Treaty Creek Project.

The project is a Joint Venture with Tudor Gold owning 3/5th and acting as operator. American Creek and Teuton Resources each have a 1/5th interest in the project creating a 3:1 ownership relationship between Tudor Gold and American Creek.

American Creek and Teuton hold fully carried 20% interests, which means no development costs are incurred by these companies until a production notice is issued. This gives shareholders a unique opportunity, to avoid the dilutive effects of exploration while maintaining their full 20% exposure to one of the world's most exciting mega deposits.

About American Creek

American Creek is a Canadian junior mineral exploration company with gold and silver properties in British Columbia, Canada.

The Corporation has an interest in the Treaty Creek property, a joint venture project with Tudor Gold located in BC's prolific "Golden Triangle".

The Corporation also holds the Austruck-Bonanza gold property located near Kamloops.

For further information please contact Kelvin Burton at:

Phone: 403 752-4040 or Email: This email address is being protected from spambots. You need JavaScript enabled to view it..

Information relating to the Corporation is available on its website at www.americancreek.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Corporation expects or anticipates will or may occur in the future, including the completion and anticipated results of planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the Corporation's planned exploration activities will be completed in a timely manner. Although the assumptions made by the Corporation in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Corporation's plans or expectations include risks relating to the actual results of current exploration activities, fluctuating gold prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Corporation with securities regulators.

Although the Corporation has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/227773

American Creek's JV Partner Tudor Gold Discovers a Fourth High-Grade Gold Target, Supercell-1D (SC-1D) at Treaty Creek, Golden Triangle of British Columbia; Intersects 10.92 g/t Gold Equivalent (AuEQ) over 3.00 Meters Within Supercell-1C (SC-1C) and 5.70 g/t AuEQ over 3.00 Meters Within SC-1D

Cardston, Alberta--(Newsfile Corp. - October 9, 2024) - American Creek Resources Ltd. (TSXV: AMK) (OTCQB: ACKRF)("the Corporation" or "American Creek") is pleased to announce that project operator and JV partner Tudor Gold ("Tudor") has produced the results from the final three drill-holes completed from the 2024 exploration drilling program (the "Program") that totaled 10,530 meters (m) at the flagship Treaty Creek Project, located in the heart of the Golden Triangle of Northwestern British Columbia.

The Supercell-One Zone (SC-1) was identified earlier this year to represent a significant potential economic target that is within, and peripheral to, the CS-600 Domain (see press releases dated February 2nd, August 14th, and September 11th, 2024). The discovery of a fourth sub-parallel gold bearing breccia system (SC-1D) continues the expansion of the Supercell-One system. Drillhole GS-24-187 intersected 10.92 g/t AuEQ over 3.00 m within SC-1C and 5.70 g/t AuEQ over 3.00 m within a newly discovered SC-1D zone, both occurring within a strongly mineralized envelope that returned 1.43 g/t AuEQ over 99.00 m. The gold-rich SC-1 system occurs within an area measuring up to 800 m in length by 400 m in depth. All four stacked, sub-parallel structures remain open in all directions and to depth.

Drilling Highlights:

Hole GS-24-185 intersected a 150 m eastward step-out of the CS-600 Domain and the new SC-1D zone.

CS-600: 1.01 g/t AuEQ over 200.50 m (0.92 g/t Au, 2.69 g/t Ag, 0.05% Cu)

Including: 2.18 g/t AuEQ over 21.00 m (1.95 g/t Au, 2.92 g/t Ag, 0.17% Cu)

SC-1D: 9.60 g/t AuEQ over 13.50 m (9.58 g/t Au, 0.44 g/t Ag, 0.01% Cu) - previously reported September 11th, 2024

Hole GS-24-186 intersected an 85 m northward step-out of the SC-1A zone.

- SC-1A: 10.40 g/t AuEQ over 1.50 m (9.78 g/t Au, 22.46 g/t Ag, 0.02% Cu)

Hole GS-24-187 intersected a 200 m northeastward step-out of the SC-1C zone, a 130 m northward step-out of the SC-1D zone and a 120 m northward step-out of the CS-600 Domain.

SC-1C: 10.92 g/t AuEQ over 3.00 m (10.89 g/t Au, 0.97 g/t Ag, 0.02% Cu)

SC-1D: 5.70 g/t AuEQ over 3.00 m (5.65 g/t Au, 0.95 g/t Ag, 0.03% Cu)

CS-600: 1.22 g/t AuEQ over 115.50 m (0.75 g/t Au, 2.22 g/t Ag, 0.36% Cu)

Including: 1.68g/t AuEQ over 10.50 m (0.13 g/t Au, 4.76 g/t Ag, 1.22% Cu)

Click the following links to view a plan map and cross sections for holes GS-24-185, 186 and 187.

Ken Konkin, Tudor Gold President and CEO, comments: "We are extremely pleased to announce the continued discovery of multiple sub-parallel, stacked, micro-breccia systems within the Supercell Complex. The consistent high-grade gold intercepts were discovered from the wide-spaced step-out drilling targeting the open-ended CS-600 domain in the northern and eastern areas of the Goldstorm Deposit. Crews were pleasantly surprized to observe consistent gold mineralization within the series of late-stage gold-dominant quartz-pyrite micro-breccia structures. We also reviewed and re-interpreted an earlier intercept from hole GS-24-185 that was initially thought to have been an off-set to Supercell-1C (SC-1C) but subsequent drilling confirmed that this 13.5 m intercept of 9.60 g/t AuEq belongs to Supercell-1D which lies directly below SC-1C as it appears to be an individual splay emanating from SC-1C as a new sub-parallel Supercell-1D (SC-1D). This newly discovered SC-1D was also intersected by drill hole GS-24-187 and yielded 3.0 m of 5.7 g/t AuEq.

Additionally, an 85 m northward step-out with hole GS-24-186 intersected 10.40 g/t AuEq over 1.5 m, within the SC-1A breccia zone, the uppermost micro-breccia system discovered to-date. Our wide-spaced step-out drilling was equally successful in expanding the CS-600 domain well outside the known area of the Goldstorm Deposit towards the northeast. Significant gold, copper and silver mineralization was encountered with the 150 m eastward step-out hole GS-24-185 (1.01 g/t AuEq over 200.5 m) and the 120 m northern step-out hole GS-24-187 that intersected 1.22 g/t AuEq over 115.5 m. Although the Goldstorm Deposit remains open in all directions and at depth, our priority focus is on the Supercell Complex.

This system holds great potential for enhancing the economic advantage of the Treaty Creek Project. The Goldstorm Deposit now contains a high-grade component that can be traced for over 800 m along a northern axis with a moderate westward dipping axis that measures over 400m. Our goal is to expand the limits of the four newly discovered Supercell structures to maximize the economic potential of these gold-dominant breccia systems as a possible starter mine, and to gain access to the CS-600 domain by utilizing the same infrastructure required to potentially mine the Supercell material. It is unknown if we will ever reach the limits of the Goldstorm Deposit as our technical team will concentrate all efforts on the high-grade portions of the Deposit. We plan to review other gold-dominant sub-domains such as R-66 and 300N that appear to have similar structural controls, and are composed of similar quartz-pyrite micro-breccia veinlets, to hopefully add to the growing high-grade gold story of the Goldstorm Deposit at Treaty Creek, within the heart of the Golden Triangle."

Drilling Discussion

Section A

- GS-24-185: This hole was drilled to step out 140 m from previously drilled SC-1C mineralization, as well as infilling CS-600 mineralization at depth. The hole intersected 13.50 m grading 9.60 g/t AuEQ (9.58 g/t Au, 0.44 g/t Ag, 0.01% Cu)* which is now interpreted as occurring within a fourth zone (SC-1D) of the network of subparallel brecciated Supercell-One complex of structures. This hole also intersected 200.50 m grading 1.01 g/t AuEQ (0.92 g/t Au, 2.69 g/t Ag, 0.05% Cu) of the CS-600 Domain representing a 150 m step-out towards the east.

*Previously reported (September 11th, 2024)

- GS-24-186: This hole was drilled to intersect SC-1 structures and CS-600 mineralization to the north. An intercept of 10.40 g/t AuEQ over 1.50 m (9.78 g/t Au, 22.46 g/t Ag, 0.02% Cu) represents an 85 m northward step-out of the SC-1A zone. Additionally, the CS-600 domain was intersected over 45.00 m grading 1.21 g/t AuEQ (0.86 g/t Au, 2.16 g/t Ag, 0.26% Cu).

- GS-24-187: This 150 m - 200 m northeastward step-out hole tested the extents of multiple SC-1 zones as well as the CS-600 Domain. The hole intersected a wide envelope of Au rich mineralization surrounding intercepts of SC-1C and SC-1D zones, totaling 99.00 m grading 1.43 g/t AuEQ (1.36 g/t Au, 2.21 g/t Ag, 0.04% Cu), which included 10.92 g/t AuEQ over 3.00 m (10.89 g/t Au, 0.97 g/t Ag, 0.02% Cu) within the SC-1C zone, and 5.70 g/t AuEQ over 3.00 m (5.65 g/t Au, 0.95 g/t Ag, 0.03% Cu) within the SC-1D zone. A further intercept of CS-600: 1.22 g/t AuEQ over 115.50 m (0.75 g/t Au, 2.22 g/t Ag, 0.36% Cu) expanded the CS-600 domain over 120 m to the north.

Table 1: Drilling Results for Goldstorm Deposit in Press Release October 8, 2024

| Section | Hole | Zone | From | To | Interval | Au | Ag | Cu | AuEQ |

| (m) | (m) | (m) | (g/t) | (g/t) | (%) | (g/t) | |||

| B | GS-24-185 | CS-600 | 1094.00 | 1294.5 | 200.50 | 0.92 | 2.69 | 0.05 | 1.01 |

| Inc. | 1105.50 | 1126.50 | 21.00 | 1.95 | 2.92 | 0.17 | 2.18 | ||

| GS-24-186 | SC-1A | 787.50 | 789.00 | 1.50 | 9.78 | 22.46 | 0.02 | 10.40 | |

| CS-600 | 1261.50 | 1306.50 | 45.00 | 0.86 | 2.16 | 0.26 | 1.21 | ||

| Inc. | 1265.00 | 1288.20 | 23.20 | 1.11 | 2.97 | 0.47 | 1.73 | ||

| A | GS-24-187 | SC-1C | 919.50 | 922.50 | 3.00 | 10.89 | 0.97 | 0.02 | 10.92 |

| SC-1D | 975.00 | 978.00 | 3.00 | 5.65 | 0.95 | 0.03 | 5.70 | ||

| SC-1 | 919.50 | 1018.50 | 99.00 | 1.36 | 2.21 | 0.04 | 1.43 | ||

| CS-600 | 1074.00 | 1189.50 | 115.50 | 0.75 | 2.22 | 0.36 | 1.22 | ||

| Inc. | 1098.00 | 1108.50 | 10.50 | 0.13 | 4.76 | 1.22 | 1.68 | ||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

Table 2: Drill data for holes in Press Release October 8, 2024

| Section | Hole ID | UTM E NAD 83 | UTM N NAD 83 | Elevation (m) | Azi (ᵒ) | Dip (ᵒ) | Depth (m) |

| B | GS-24-185 | 429306 | 6274219 | 1373 | 240 | -76 | 1350 |

| A | GS-24-186 | 428982 | 6274265 | 1462 | 265 | -82 | 1566 |

| B | GS-24-187 | 429306 | 6274219 | 1373 | 265 | -83 | 1440 |

Qualified Person

The Qualified Person for this news release for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") is Tudor Gold's President and CEO, Ken Konkin, P.Geo. He has read and approved the scientific and technical information that forms the basis for the disclosure contained in this news release.

QA/QC

Diamond drill core samples were prepared at MSA Labs' Preparation Laboratory in Terrace, BC and assayed at MSA Labs' Geochemical Laboratory in Langley, BC. Analytical accuracy and precision are monitored by the submission of blanks, certified standards and duplicate samples inserted at regular intervals into the sample stream by Tudor Gold personnel. MSA Laboratories' quality system complies with the requirements for the International Standards ISO 17025 and ISO 9001. MSA Labs is independent of Tudor Gold.

About Treaty Creek

The Treaty Creek Project hosts the Goldstorm Deposit, comprising a large gold-copper porphyry system, as well as several other mineralized zones. As disclosed in the "NI-43-101 Technical Report for the Treaty Creek Project", dated April 5, 2024 prepared by Garth Kirkham Geosystems and JDS Energy & Mining Inc., the Goldstorm Deposit has an Indicated Mineral Resource of 27.87 million ounces (Moz) of AuEQ grading 1.19 g/t AuEQ (21.66 Moz gold grading 0.92 g/t, 2.87 billion pounds (Blbs) copper grading 0.18%, 128.73 Moz silver grading 5.48 g/t) and an Inferred Mineral Resource of 6.03 Moz of AuEQ grading 1.25 g/t AuEQ (4.88 Moz gold grading 1.01 g/t, 503.2 Mlb copper grading 0.15%, 28.97 Moz silver grading 6.02 g/t), with a pit constrained cut-off of 0.7 g/t AuEQ and an underground cut-off of 0.75 g/t AuEQ.

The Goldstorm Deposit has been categorized into three dominant mineral domains and several smaller mineral domains. The CS-600 domain largely consists of nested pulses of diorite intrusive stocks and hosts the majority of the copper mineralization within the Goldstorm Deposit. CS-600 has an Indicated Mineral Resource of 15.65 Moz AuEQ grading 1.22 g/t AuEQ (9.99 Moz gold grading 0.78 g/t, 2.73 Blbs copper grading 0.31%, 73.47 Moz silver grading 5.71 g/t) and an Inferred Mineral Resource of 2.86 Moz AuEQ grading 1.20 g/t AuEQ (1.87 Moz gold grading 0.79 g/t, 475.6 Mlb copper grading 0.29%, 13.4 Moz silver grading 5.63 g/t). The Goldstorm Deposit remains open in all directions and requires further exploration drilling to determine the size and extent of the Deposit.

1 AuEq = Au g/t + (Ag g/t*0.0098765) + (Cu ppm*0.0001185)

Treaty Creek JV Partnership

American Creek is a proud partner in the Treaty Creek Project.

The project is a Joint Venture with Tudor Gold owning 3/5th and acting as operator. American Creek and Teuton Resources each have a 1/5th interest in the project creating a 3:1 ownership relationship between Tudor Gold and American Creek.

American Creek and Teuton hold fully carried 20% interests, which means no development costs are incurred by these companies until a production notice is issued. This gives shareholders a unique opportunity, to avoid the dilutive effects of exploration while maintaining their full 20% exposure to one of the world's most exciting mega deposits.

About American Creek

American Creek is a Canadian junior mineral exploration company with gold and silver properties in British Columbia, Canada.

The Corporation has an interest in the Treaty Creek property, a joint venture project with Tudor Gold located in BC's prolific "Golden Triangle".

The Corporation also holds the Austruck-Bonanza gold property located near Kamloops.

For further information please contact Kelvin Burton at:

Phone: 403 752-4040 or Email: This email address is being protected from spambots. You need JavaScript enabled to view it..

Information relating to the Corporation is available on its website at www.americancreek.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Corporation expects or anticipates will or may occur in the future, including the completion and anticipated results of planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the Corporation's planned exploration activities will be completed in a timely manner. Although the assumptions made by the Corporation in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Corporation's plans or expectations include risks relating to the actual results of current exploration activities, fluctuating gold prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Corporation with securities regulators.

Although the Corporation has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/226072

American Creek Resources Receives Signing Fee Payment from Cunningham Mining

Cardston, Alberta--(Newsfile Corp. - October 2, 2024) - American Creek Resources Ltd. (TSXV: AMK) (OTCQB: ACKRF) (the "Company" or "American Creek") announces that it has received the $300,000 cash signing fee payment from Cunningham Mining Ltd. ("CML"), as required by the definitive arrangement agreement dated September 5, 2024 between the Company and CML, the details of which are set out in the Company's news release of September 6, 2024.

The parties are currently working on documentation for the Company's upcoming annual general and special meeting at which, amongst other things, shareholders will be asked to approve the statutory plan of arrangement with CML. The Company will provide further details regarding the meeting once they are finalized.

Darren Blaney, CEO of American Creek, stated: "We are pleased that this transaction is moving along in a timely manner. After fielding some questions on the matter, we also want to take this opportunity to clarify that the previous voting agreement Mr. Sprott had with the Company expired July 31, 2024, therefore, he was under no legal obligation to support this proposed arrangement with Cunningham. As previously stated, we are pleased to have Eric Sprott's full support and endorsement of this transaction."

About American Creek and the Treaty Creek Project

American Creek is a proud partner in the Treaty Creek Project, a joint venture with Tudor Gold Corp. located in BC's prolific "Golden Triangle".

American Creek holds a fully carried 20% interest in the Treaty Creek Project until a production notice is given, meaning that no exploration or development costs are incurred by American Creek until such time as a production notice has been issued. American Creek shareholders have a unique opportunity to avoid the dilutive effects of exploration while maintaining their full 20% exposure to one of the world's most exciting mega deposits.

The Company also holds the Austruck-Bonanza gold property located near Kamloops, BC.

ON BEHALF OF AMERICAN CREEK RESOURCES LTD.

"Darren Blaney"

Darren Blaney, President & CEO

For further information please contact Kelvin Burton at:

Phone: (403)752-4040 or Email: This email address is being protected from spambots. You need JavaScript enabled to view it..

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Statements

This news release may contain forward-looking statements (within the meaning of applicable securities laws) which reflect American Creek's current expectations regarding future events. Forward-Looking statements are identified by words such as "believe", "anticipate", "project", "expect", "intend", "plan", "will", "may", "estimate" and other similar expressions. The forward-looking statements in this news release are based on a number of key expectations and assumptions made by American Creek as of the date hereof. Although the forward-looking statements contained in this news release are based on what American Creek's management believes to be reasonable assumptions, American Creek cannot assure investors that actual results will be consistent with such statements.

The forward-looking statements in this news release are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Several factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including those identified in American Creek's most recent Management's Discussion and Analysis, which is available on SEDAR+ at www.sedarplus.ca. Readers, therefore, should not place undue reliance on any such forward-looking statements. These forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, American Creek assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/225345

American Creek's JV Partner Tudor Gold Expands High-grade Gold Target; Intersects 9.60 G/t Gold Equivalent (AuEQ) over 13.5 Meters Within Supercell - 1C (SC-1C) in a 140m Step-Out Drill Hole at Treaty Creek, Golden Triangle, British Columbia

Cardston, Alberta--(Newsfile Corp. - September 11, 2024) - American Creek Resources Ltd. (TSXV: AMK) ("the Corporation" or "American Creek") is pleased to announce that project operator and JV partner Tudor Gold ("Tudor") has produced the results from the fifth hole completed from the 2024 exploration drilling program (the "Program") at the flagship property, Treaty Creek, located in the heart of the Golden Triangle of Northwestern British Columbia. The 2024 Program has recently been safely completed, totaling 10,530 meters (m) with all crews and drilling equipment demobilized from site.

The Supercell-One Zone (SC-1) was identified earlier this year to represent a significant potential economic target that is within, and peripheral to, the CS-600 Domain (see press releases dated February 2 and May 10). The Supercell-One system has greatly expanded with the discovery of two additional sub-parallel (SC-1A and SC-1B) hydrothermal gold-bearing quartz micro-breccia systems above the original SC-1, now labeled as SC-1C. This reported intercept of high-grade gold mineralization within drill hole GS-24-185 expands the size of SC-1C greatly by stepping out from previous drilling intercepts by 255 m up-dip and 140 m along strike. The gold-rich SC-1 system occurs within an area measuring up to 800 m in length by 400 m in depth. All three sub-parallel structures remain open in all directions and to depth. Assays remain pending on an additional intercept of CS-600 Domain in the lower section of GS-24-185.

SC-1C Drilling Highlights (2024):

Hole GS-24-185 intersected a high-grade interval of the Supercell-One System

- SC-1C; 9.60 g/t AuEQ over 13.50 m (9.58 g/t Au, 0.44 g/t Ag, 0.01% Cu)

Click the following links to view a plan map and cross sections for hole GS-24-185.

Ken Konkin, Tudor Gold President and CEO, comments: "We are very pleased with this newest high-grade result in the planned 140 m northerly step-out from GS-24-184, which intersected 8.09 g/t AuEQ over 6.15 m and a 250 m easterly step-out from GS-24-181, which intersected 5.31g/t AuEQ over 6.00 m (results from news release August 14, 2024). As we continue to expand these systems of high-grade structures farther to the northeast, the gold grades, and the size of the system, are increasing. We are now focusing efforts on examining previous drill intercepts that carry similar high-grade gold values to determine how far the Supercells may have pierced the nucleus of the Goldstorm Domains. Our goal is to define the 'vascular system' of the Supercells as they may be entwined within the heart of the CS-600 Domain, and to continue to trace the extent of these systems in all directions. Although drilling has been completed for this season, results from the final three holes are pending. We believe that the discovery of numerous high-grade gold-bearing structures confirms the presence of a large hydrothermal gold-dominant, late-stage, over-printed system that will give the project a major economic advantage."

Drilling Discussion

Section B

- GS-24-185: This hole was drilled to step out 140 m from previously drilled SC-1C mineralization, as well as infilling CS-600 mineralization at depth. The hole intersected 13.50 m grading 9.60 g/t AuEQ (9.58 g/t Au, 0.44 g/t Ag, 0.01% Cu) as part of the network of subparallel brecciated Supercell-One complex of structures. This hole also intersected mineralization typical of the CS-600 domain, and assays that remain pending for this intercept will be released in the near future.

Table 1: Drilling Results for Goldstorm Deposit in Press Release September 10, 2024

| Section | Hole | Zone | From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

Cu (%) |

AuEQ (g/t) |

| B | GS-24-185 | SC-1C | 880.50 | 894.00 | 13.50 | 9.58 | 0.44 | 0.01 | 9.60 |

| Inc. | 880.50 | 882.00 | 1.50 | 19.60 | 0.54 | 0.01 | 19.62 | ||

| Inc. | 882.00 | 883.50 | 1.50 | 6.36 | 0.36 | 0.01 | 6.38 | ||

| Inc. | 883.50 | 885.00 | 1.50 | 11.40 | 0.34 | 0.01 | 11.42 | ||

| Inc. | 885.00 | 886.50 | 1.50 | 11.60 | 0.32 | 0.01 | 11.61 | ||

| Inc. | 886.50 | 888.00 | 1.50 | 7.46 | 0.41 | 0.01 | 7.48 | ||

| Inc. | 888.00 | 889.50 | 1.50 | 1.67 | 0.20 | 0.01 | 1.68 | ||

| Inc. | 889.50 | 891.00 | 1.50 | 9.23 | 0.65 | 0.01 | 9.25 | ||

| Inc. | 891.00 | 892.50 | 1.50 | 12.10 | 0.57 | 0.01 | 12.12 | ||

| Inc. | 892.50 | 894.00 | 1.50 | 6.82 | 0.55 | 0.01 | 6.84 |

- All assay values are uncut and intervals reflect drilled intercept lengths.

- HQ and NQ2 diameter core samples were sawn in half and typically sampled at standard 1.5 m intervals.

- The following metal prices were used to calculate the Au Eq metal content: Gold $1850/oz, Ag: $21/oz, Cu: $3.75/lb. Calculations used the formula AuEQ = Au g/t + (Ag g/t*0.0100901) + (Cu ppm*0.0001236). All metals are reported in USD and calculations consider recoveries of 90 % for gold, 80 % for copper, and 80 % for silver.

- True widths have not been determined as the mineralized body remains open in all directions. Further drilling is required to determine the mineralized body orientation and true widths.

Table 2: Drill data for holes in Press Release September 10, 2024

| Section | Hole ID | UTM E NAD 83 | UTM N NAD 83 | Elevation (m) | Azi (ᵒ) | Dip (ᵒ) | Depth (m) |

| B | GS-24-185 | 429306 | 6274219 | 1373 | 240 | -76 | 1350.00 |

Qualified Person

The Qualified Person for this news release for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") is Tudor Gold's President and CEO, Ken Konkin, P.Geo. He has read and approved the scientific and technical information that forms the basis for the disclosure contained in this news release.

QA/QC

Diamond drill core samples were prepared at MSA Labs' Preparation Laboratory in Terrace, BC and assayed at MSA Labs' Geochemical Laboratory in Langley, BC. Analytical accuracy and precision are monitored by the submission of blanks, certified standards and duplicate samples inserted at regular intervals into the sample stream by Tudor Gold personnel. MSA Laboratories' quality system complies with the requirements for the International Standards ISO 17025 and ISO 9001. MSA Labs is independent of Tudor Gold.

About Treaty Creek

The Treaty Creek Project hosts the Goldstorm Deposit, comprising a large gold-copper porphyry system, as well as several other mineralized zones. As disclosed in the "NI-43-101 Technical Report for the Treaty Creek Project", dated April 5, 2024 prepared by Garth Kirkham Geosystems and JDS Energy & Mining Inc., the Goldstorm Deposit has an Indicated Mineral Resource of 27.87 million ounces (Moz) of AuEQ grading 1.19 g/t AuEQ (21.66 Moz gold grading 0.92 g/t, 2.87 billion pounds (Blbs) copper grading 0.18%, 128.73 Moz silver grading 5.48 g/t) and an Inferred Mineral Resource of 6.03 Moz of AuEQ grading 1.25 g/t AuEQ (4.88 Moz gold grading 1.01 g/t, 503.2 Mlb copper grading 0.15%, 28.97 Moz silver grading 6.02 g/t), with a pit constrained cut-off of 0.7 g/t AuEQ and an underground cut-off of 0.75 g/t AuEQ.

The Goldstorm Deposit has been categorized into three dominant mineral domains and several smaller mineral domains. The CS-600 domain largely consists of nested pulses of diorite intrusive stocks and hosts the majority of the copper mineralization within the Goldstorm Deposit. CS-600 has an Indicated Mineral Resource of 15.65 Moz AuEQ grading 1.22 g/t AuEQ (9.99 Moz gold grading 0.78 g/t, 2.73 Blbs copper grading 0.31%, 73.47 Moz silver grading 5.71 g/t) and an Inferred Mineral Resource of 2.86 Moz AuEQ grading 1.20 g/t AuEQ (1.87 Moz gold grading 0.79 g/t, 475.6 Mlb copper grading 0.29%, 13.4 Moz silver grading 5.63 g/t). The Goldstorm Deposit remains open in all directions and requires further exploration drilling to determine the size and extent of the Deposit.

1 AuEq = Au g/t + (Ag g/t*0.0098765) + (Cu ppm*0.0001185)

Treaty Creek JV Partnership

American Creek is a proud partner in the Treaty Creek Project.

The project is a Joint Venture with Tudor Gold owning 3/5th and acting as operator. American Creek and Teuton Resources each have a 1/5th interest in the project creating a 3:1 ownership relationship between Tudor Gold and American Creek.

American Creek and Teuton hold fully carried 20% interests, which means no development costs are incurred by these companies until a production notice is issued. This gives shareholders a unique opportunity, to avoid the dilutive effects of exploration while maintaining their full 20% exposure to one of the world's most exciting mega deposits.

About American Creek

American Creek is a Canadian junior mineral exploration company with gold and silver properties in British Columbia, Canada.

The Corporation has an interest in the Treaty Creek property, a joint venture project with Tudor Gold located in BC's prolific "Golden Triangle".

The Corporation also holds the Austruck-Bonanza gold property located near Kamloops.

For further information please contact Kelvin Burton at:

Phone: 403 752-4040 or Email: This email address is being protected from spambots. You need JavaScript enabled to view it..

Information relating to the Corporation is available on its website at www.americancreek.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Corporation expects or anticipates will or may occur in the future, including the completion and anticipated results of planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the Corporation's planned exploration activities will be completed in a timely manner. Although the assumptions made by the Corporation in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Corporation's plans or expectations include risks relating to the actual results of current exploration activities, fluctuating gold prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Corporation with securities regulators.

Although the Corporation has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

American Creek's JV Partner Tudor Gold Expands High-grade Gold Target; Intersects 9.60 G/t Gold Equivalent (AuEQ) over 13.5 Meters Within Supercell - 1C (SC-1C) in a 140m Step-Out Drill Hole at Treaty Creek, Golden Triangle, British Columbia

Cardston, Alberta--(Newsfile Corp. - September 11, 2024) - American Creek Resources Ltd. (TSXV: AMK) ("the Corporation" or "American Creek") is pleased to announce that project operator and JV partner Tudor Gold ("Tudor") has produced the results from the fifth hole completed from the 2024 exploration drilling program (the "Program") at the flagship property, Treaty Creek, located in the heart of the Golden Triangle of Northwestern British Columbia. The 2024 Program has recently been safely completed, totaling 10,530 meters (m) with all crews and drilling equipment demobilized from site.

The Supercell-One Zone (SC-1) was identified earlier this year to represent a significant potential economic target that is within, and peripheral to, the CS-600 Domain (see press releases dated February 2 and May 10). The Supercell-One system has greatly expanded with the discovery of two additional sub-parallel (SC-1A and SC-1B) hydrothermal gold-bearing quartz micro-breccia systems above the original SC-1, now labeled as SC-1C. This reported intercept of high-grade gold mineralization within drill hole GS-24-185 expands the size of SC-1C greatly by stepping out from previous drilling intercepts by 255 m up-dip and 140 m along strike. The gold-rich SC-1 system occurs within an area measuring up to 800 m in length by 400 m in depth. All three sub-parallel structures remain open in all directions and to depth. Assays remain pending on an additional intercept of CS-600 Domain in the lower section of GS-24-185.

SC-1C Drilling Highlights (2024):

Hole GS-24-185 intersected a high-grade interval of the Supercell-One System

- SC-1C; 9.60 g/t AuEQ over 13.50 m (9.58 g/t Au, 0.44 g/t Ag, 0.01% Cu)

Click the following links to view a plan map and cross sections for hole GS-24-185.

Ken Konkin, Tudor Gold President and CEO, comments: "We are very pleased with this newest high-grade result in the planned 140 m northerly step-out from GS-24-184, which intersected 8.09 g/t AuEQ over 6.15 m and a 250 m easterly step-out from GS-24-181, which intersected 5.31g/t AuEQ over 6.00 m (results from news release August 14, 2024). As we continue to expand these systems of high-grade structures farther to the northeast, the gold grades, and the size of the system, are increasing. We are now focusing efforts on examining previous drill intercepts that carry similar high-grade gold values to determine how far the Supercells may have pierced the nucleus of the Goldstorm Domains. Our goal is to define the 'vascular system' of the Supercells as they may be entwined within the heart of the CS-600 Domain, and to continue to trace the extent of these systems in all directions. Although drilling has been completed for this season, results from the final three holes are pending. We believe that the discovery of numerous high-grade gold-bearing structures confirms the presence of a large hydrothermal gold-dominant, late-stage, over-printed system that will give the project a major economic advantage."

Drilling Discussion

Section B

- GS-24-185: This hole was drilled to step out 140 m from previously drilled SC-1C mineralization, as well as infilling CS-600 mineralization at depth. The hole intersected 13.50 m grading 9.60 g/t AuEQ (9.58 g/t Au, 0.44 g/t Ag, 0.01% Cu) as part of the network of subparallel brecciated Supercell-One complex of structures. This hole also intersected mineralization typical of the CS-600 domain, and assays that remain pending for this intercept will be released in the near future.

Table 1: Drilling Results for Goldstorm Deposit in Press Release September 10, 2024

| Section | Hole | Zone | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Cu (%) | AuEQ (g/t) |

| B | GS-24-185 | SC-1C | 880.50 | 894.00 | 13.50 | 9.58 | 0.44 | 0.01 | 9.60 |

| Inc. | 880.50 | 882.00 | 1.50 | 19.60 | 0.54 | 0.01 | 19.62 | ||

| Inc. | 882.00 | 883.50 | 1.50 | 6.36 | 0.36 | 0.01 | 6.38 | ||

| Inc. | 883.50 | 885.00 | 1.50 | 11.40 | 0.34 | 0.01 | 11.42 | ||

| Inc. | 885.00 | 886.50 | 1.50 | 11.60 | 0.32 | 0.01 | 11.61 | ||

| Inc. | 886.50 | 888.00 | 1.50 | 7.46 | 0.41 | 0.01 | 7.48 | ||

| Inc. | 888.00 | 889.50 | 1.50 | 1.67 | 0.20 | 0.01 | 1.68 | ||

| Inc. | 889.50 | 891.00 | 1.50 | 9.23 | 0.65 | 0.01 | 9.25 | ||

| Inc. | 891.00 | 892.50 | 1.50 | 12.10 | 0.57 | 0.01 | 12.12 | ||

| Inc. | 892.50 | 894.00 | 1.50 | 6.82 | 0.55 | 0.01 | 6.84 |

- All assay values are uncut and intervals reflect drilled intercept lengths.

- HQ and NQ2 diameter core samples were sawn in half and typically sampled at standard 1.5 m intervals.

- The following metal prices were used to calculate the Au Eq metal content: Gold $1850/oz, Ag: $21/oz, Cu: $3.75/lb. Calculations used the formula AuEQ = Au g/t + (Ag g/t*0.0100901) + (Cu ppm*0.0001236). All metals are reported in USD and calculations consider recoveries of 90 % for gold, 80 % for copper, and 80 % for silver.

- True widths have not been determined as the mineralized body remains open in all directions. Further drilling is required to determine the mineralized body orientation and true widths.

Table 2: Drill data for holes in Press Release September 10, 2024

| Section | Hole ID | UTM E NAD 83 | UTM N NAD 83 | Elevation (m) | Azi (ᵒ) | Dip (ᵒ) | Depth (m) |

| B | GS-24-185 | 429306 | 6274219 | 1373 | 240 | -76 | 1350.00 |

Qualified Person

The Qualified Person for this news release for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") is Tudor Gold's President and CEO, Ken Konkin, P.Geo. He has read and approved the scientific and technical information that forms the basis for the disclosure contained in this news release.

QA/QC

Diamond drill core samples were prepared at MSA Labs' Preparation Laboratory in Terrace, BC and assayed at MSA Labs' Geochemical Laboratory in Langley, BC. Analytical accuracy and precision are monitored by the submission of blanks, certified standards and duplicate samples inserted at regular intervals into the sample stream by Tudor Gold personnel. MSA Laboratories' quality system complies with the requirements for the International Standards ISO 17025 and ISO 9001. MSA Labs is independent of Tudor Gold.

About Treaty Creek

The Treaty Creek Project hosts the Goldstorm Deposit, comprising a large gold-copper porphyry system, as well as several other mineralized zones. As disclosed in the "NI-43-101 Technical Report for the Treaty Creek Project", dated April 5, 2024 prepared by Garth Kirkham Geosystems and JDS Energy & Mining Inc., the Goldstorm Deposit has an Indicated Mineral Resource of 27.87 million ounces (Moz) of AuEQ grading 1.19 g/t AuEQ (21.66 Moz gold grading 0.92 g/t, 2.87 billion pounds (Blbs) copper grading 0.18%, 128.73 Moz silver grading 5.48 g/t) and an Inferred Mineral Resource of 6.03 Moz of AuEQ grading 1.25 g/t AuEQ (4.88 Moz gold grading 1.01 g/t, 503.2 Mlb copper grading 0.15%, 28.97 Moz silver grading 6.02 g/t), with a pit constrained cut-off of 0.7 g/t AuEQ and an underground cut-off of 0.75 g/t AuEQ.

The Goldstorm Deposit has been categorized into three dominant mineral domains and several smaller mineral domains. The CS-600 domain largely consists of nested pulses of diorite intrusive stocks and hosts the majority of the copper mineralization within the Goldstorm Deposit. CS-600 has an Indicated Mineral Resource of 15.65 Moz AuEQ grading 1.22 g/t AuEQ (9.99 Moz gold grading 0.78 g/t, 2.73 Blbs copper grading 0.31%, 73.47 Moz silver grading 5.71 g/t) and an Inferred Mineral Resource of 2.86 Moz AuEQ grading 1.20 g/t AuEQ (1.87 Moz gold grading 0.79 g/t, 475.6 Mlb copper grading 0.29%, 13.4 Moz silver grading 5.63 g/t). The Goldstorm Deposit remains open in all directions and requires further exploration drilling to determine the size and extent of the Deposit.

1 AuEq = Au g/t + (Ag g/t*0.0098765) + (Cu ppm*0.0001185)

Treaty Creek JV Partnership

American Creek is a proud partner in the Treaty Creek Project.

The project is a Joint Venture with Tudor Gold owning 3/5th and acting as operator. American Creek and Teuton Resources each have a 1/5th interest in the project creating a 3:1 ownership relationship between Tudor Gold and American Creek.

American Creek and Teuton hold fully carried 20% interests, which means no development costs are incurred by these companies until a production notice is issued. This gives shareholders a unique opportunity, to avoid the dilutive effects of exploration while maintaining their full 20% exposure to one of the world's most exciting mega deposits.

About American Creek

American Creek is a Canadian junior mineral exploration company with gold and silver properties in British Columbia, Canada.

The Corporation has an interest in the Treaty Creek property, a joint venture project with Tudor Gold located in BC's prolific "Golden Triangle".

The Corporation also holds the Austruck-Bonanza gold property located near Kamloops.

For further information please contact Kelvin Burton at:

Phone: 403 752-4040 or Email: This email address is being protected from spambots. You need JavaScript enabled to view it..

Information relating to the Corporation is available on its website at www.americancreek.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Corporation expects or anticipates will or may occur in the future, including the completion and anticipated results of planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the Corporation's planned exploration activities will be completed in a timely manner. Although the assumptions made by the Corporation in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Corporation's plans or expectations include risks relating to the actual results of current exploration activities, fluctuating gold prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Corporation with securities regulators.

Although the Corporation has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/222895

Cunningham Mining to Acquire American Creek Resources

Cardston, Alberta--(Newsfile Corp. - September 6, 2024) - American Creek Resources Ltd. (TSXV: AMK) (OTCQB: ACKRF) (the "Company" or "American Creek") is pleased to announce that it has entered into a definitive arrangement agreement dated September 5, 2024 (the "Arrangement Agreement") with Cunningham Mining Ltd. ("CML") pursuant to which CML has agreed to acquire all of the issued and outstanding common shares of American Creek (the "Shares") at a price of $0.43 per Share (the "Consideration"), in an arm's-length, all-cash transaction valued at approximately $207 million on a fully diluted basis (the "Transaction"). The Transaction will be completed by way of a statutory plan of arrangement under the Business Corporations Act (British Columbia) (the "BCBCA").

The Consideration represents a 274% premium to the $0.115 closing price of the Shares on the TSX Venture Exchange (the "TSXV") on June 5, 2024, being the last trading prior to the date that American Creek and CML entered into the previously announced non-binding letter of intent (the "LOI") for the Transaction, which LOI has now been superseded by the Arrangement Agreement. In addition, the Consideration represents a 153% premium to the closing price of Shares on the TSXV on September 4, 2024 and a 155% premium based on American Creek's 30-trading day volume weighted average price ("VWAP") on the TSXV for the period ending September 4, 2024. Holders of outstanding options and warrants to purchase shares of American Creek will receive a cash payment for the "in-the-money" value, if any, in respect of all vested options and warrants of American Creek. The Company announced on August 6, 2024, that at that time it had received confirmation that CML has entered into a token subscription facility of up to US$153M for a 36-month term following a centralized exchange listing of the Cunningham Mining Token, the funds from which are expected to be used to fund CML's financial obligations under the Arrangement Agreement.