In 2016 American Creek partnered with a newly formed company named Tudor Gold Corp. It was evident that Treaty Creek is of the scale that requires an operator with the experience, expertise, and wherewithal to develop this potentially world class project. The founder of Tudor, the late Walter Storm, was a very successful global businessman who financed the startup and development of Osisko Mining. With Storm’s financial support, Osisko developed the world class Canadian Malartic gold mine in Quebec, reaching a market capitalization of $4.50 Billion CAD. Mr. Storm felt that Treaty Creek had more potential than his venture with Osisko. Tudor has assembled a strong geological team and has the past experience, the technical ability, and the backing to discover the significant untapped potential of Treaty Creek.

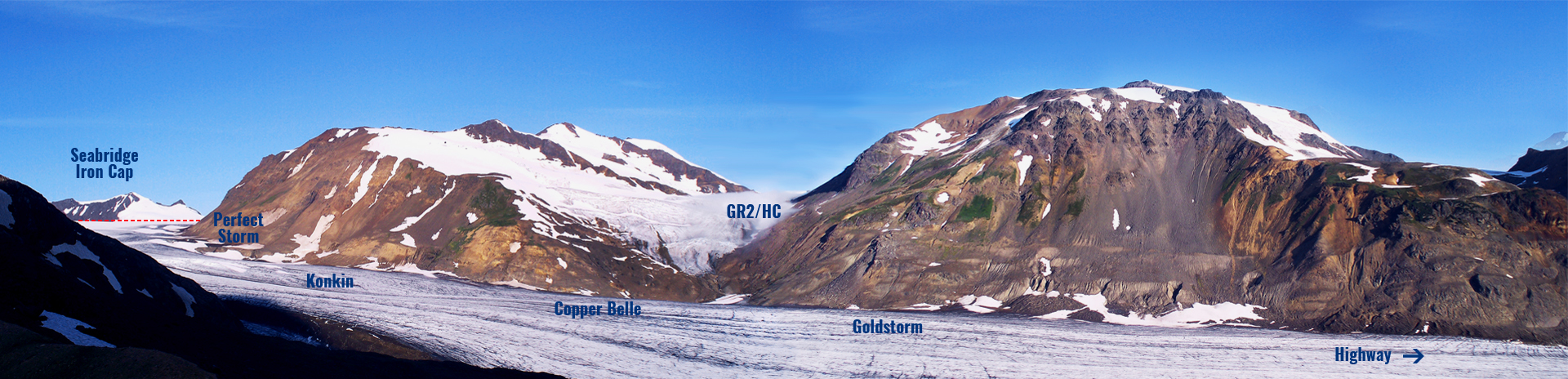

The President and CEO of Tudor Gold, Ken Konkin, spent 8 years developing the Brucejack mine (just a few kilometers south of Treaty) which was sold to Newcrest in 2022 for $3.5 Billion CAD and is now owned by Nemont. He is bringing his knowledge, experience, and expertise of the Sulphurets Hydrothermal System (along with some of his team) to develop the deposits in its northern half. Konkin not only believes the northern half has potential for similar scale deposits, but the assays are showing the gold (and gold equivalent) values get stronger the further north they expand the Goldstorm deposit (located on Treaty Creek).

American Creek owns a fully carried 20% interest in Treaty Creek until a production notice is given. This means that the project will be advanced through its exploration and development stages with no cost or share dilution to American Creek while retaining a full 20% of the project.